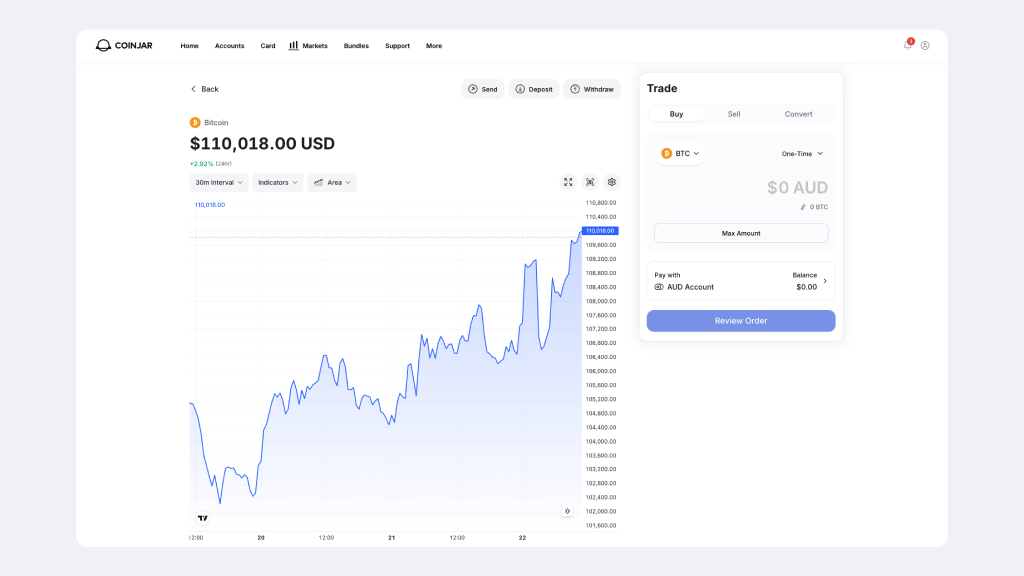

Bitcoin Hits $110,000 for the First Time in History

May 22, 2025Bitcoin just hit US$110,000. While it hasn't remained there, it is certainly hovering close. It is a huge breakthrough for every crypto bro and sis who held on through volatile times.

Share this:

The Bitcoin price has just smashed through another psychological barrier, this one being US$110,000. It means that the already amazing US$100k price milestone, passed in December of 2024, is well and truly behind us in terms of all-time-highs for Bitcoin. This newest historic price milestone for Bitcoin in its 15-year journey from obscure whitepaper to global financial phenomenon is what the crypto bros and the crypto sisters have been dreaming about all along.

This has cemented Bitcoin's status as a dominant force in the global economy.

Bitcoin Price Rise: What Pushed BTC to $110,000?

Several macroeconomic and technological catalysts have converged to push Bitcoin to new heights.

Bitcoin Being Added to Government Treasuries

Several U.S. states have recently passed laws that would allow them to hold Bitcoin as part of their state treasury reserves. This is a landmark shift in how governments view money and could act as a powerful catalyst for pushing Bitcoin’s price even higher. The exciting thing about this for Bitcoin enthusiasts? It may mean that Bitcoin has become “money” in the eyes of the government.

This is massively symbolic, but also practical. It signals that Bitcoin is not just an investment for individuals or corporations. It's now being treated as sovereign-grade money.

These laws open up a new class of buyers: State treasuries.

This shows that Bitcoin is transcending political lines. It’s no longer just a tech or libertarian movement. It’s becoming a non-political issue rooted in monetary sovereignty.

If multiple U.S. states begin buying even modest amounts of Bitcoin for their treasuries, it could trigger increased institutional demand and also increased retail (everyday buyer) demand.

Global Adoption

Over the past year, institutional investors, including BlackRock, Fidelity, and JPMorgan, have launched Bitcoin ETFs that are now listed on major stock exchanges worldwide. These products have attracted record inflows.

Inflation Hedge Demand

With inflationary pressures persisting across multiple economies, particularly in the U.S., EU, and Australia, investors may have chosen to park their funds in Bitcoin as a hedge against fiat currency debasement.

Regulatory Clarity

After years of uncertainty, major regulators including the U.S. SEC and European Central Bank have established clearer frameworks for digital assets, boosting investor confidence.

Technological Innovation

The Lightning Network (which is a Layer 2 network to make Bitcoin work more efficiently) has seen increased adoption. This is enabling near-instant, and cheaper global transactions. This is heading towards Bitcoin being a global currency that can be used all over the world in a real sense.

Political Instability

Escalating tensions with free speech across several Western countries have driven demand for censorship-resistant, borderless money.

Bitcoin’s Price Evolution

Bitcoin was born in January 2009 when the enigmatic Satoshi Nakamoto mined the Genesis Block. At the time, it had no monetary value. It was a philosophical mission: “A peer-to-peer electronic cash system.”

In 2009, Bitcoin was worth $0.00. The first known purchase was in 2010: Programmer Laszlo Hanyecz bought two pizzas for 10,000 BTC (~US$41). This is now celebrated as Bitcoin Pizza Day. By year-end, Bitcoin hits $0.08.

From there, through ups and downs, we arrive at 2025. Bitcoin broke $100,000 in the previous December and powered toward $110,000 within months. Now, with the $110k barrier passed, we are in a brave new world.

What Does This Mean for the Future?

As Bitcoin crosses this monumental psychological barrier, analysts and economists are divided on what comes next. Some predict short-term consolidation, while others believe we’re witnessing the final phase of Bitcoin’s ascent to becoming a global reserve currency.

One thing is clear: Bitcoin is no longer an experiment, it is financial infrastructure.

CoinJar’s digital currency exchange services are operated by CoinJar Australia Pty Ltd ACN 648 570 807, a registered digital currency exchange provider with AUSTRAC.

CoinJar Card is a prepaid Mastercard issued by EML Payment Solutions Limited ABN 30 131 436 532 AFSL 404131 pursuant to license by Mastercard. CoinJar Australia Pty Ltd is an authorised representative of EML Payment Solutions Limited (AR No 1290193). We recommend you consider the Product Disclosure Statement and Target Market Determination before making any decision to acquire the product. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

Google Pay is a trademark of Google LLC. Apple Pay is a trademark of Apple Inc.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Share this:

On/Offchain

Your weekly dose of crypto news & opinion.

Join more than 150,000 subscribers to CoinJar's crypto newsletter.

Your information is handled in accordance with CoinJar’s Collection Statement.

More from CoinJar Blog

Wealth Transfer From Boomers Could Benefit Crypto

September 25, 2025The upcoming wealth transfer from Boomers to Gen X to Millennials is set to benefit crypto if current trends are anything to go by. Read more

Onchain: Fall is upon us*

September 24, 2025*at least in my hemisphere. Whether it'll also be the fall of civilization remains to be seen. But if we learned anything from history books, decline tends to be a process, not...Read more

BTC & ETH Prices Rose After ETF Filings. Which Cryptos are Next?

September 23, 2025Bitcoin and Ethereum climbed after ETF filings, leaving investors curious which altcoins might be next. Here's a list to keep an eye on.Read moreYour information is handled in accordance with CoinJar’s Collection Statement.

CoinJar’s digital currency exchange services are operated by CoinJar Australia Pty Ltd ACN 648 570 807, a registered digital currency exchange provider with AUSTRAC.

CoinJar Card is a prepaid Mastercard issued by EML Payment Solutions Limited ABN 30 131 436 532 AFSL 404131 pursuant to license by Mastercard. CoinJar Australia Pty Ltd is an authorised representative of EML Payment Solutions Limited (AR No 1290193). We recommend you consider the Product Disclosure Statement and Target Market Determination before making any decision to acquire the product. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

Google Pay is a trademark of Google LLC. Apple Pay is a trademark of Apple Inc.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.