Buy Aave in Australia on CoinJar

Aave

AAVE

Overview

What is Aave?

Buy Aave: Why do investors buy Aave? On Planet Crypto, Aave is an interesting decentralised lending platform that is worth investigating. So here’s the skinny on what you can do on the protocol.

Aave emerged from the brain of Stani Kulechov, who founded a venture called ETHLend in 2017.

Inspired by Ethereum’s capabilities, Kulechov aimed to create a peer-to-peer lending and borrowing platform.

In January 2020, he rebranded ETHLend as Aave and launched it on the Ethereum mainnet. Since then, Aave has expanded to other blockchain networks, including Avalanche, Fantom, Harmony, Arbitrum, Polygon, and Optimism.

What you can do on the platform

Decentralised lending

The platform allows users to lend and borrow digital assets without intermediaries like banks. It’s a trustless system where smart contracts handle transactions transparently.

Liquidity pools

Users deposit into liquidity pools. These pools serve as the source of funds for borrowers. Lenders earn interest by contributing to these pools.

Flash loans

Flash loans are a unique type of loan available on the platform.

Flash loans are lightning-fast loans that don’t require any collateral. Unlike traditional loans, where you need to put up assets as security, flash loans allow you to borrow without providing collateral upfront.

The catch is that you must repay the entire loan amount within the same transaction. If you fail to do so, the entire transaction is reversed, and the loan is canceled. This tight timeframe ensures that flash loans are used for specific purposes and don’t linger indefinitely.

Flash loans are popular among traders and arbitrageurs. They can borrow funds instantly, execute profitable trades across different platforms, and then repay the loan — all within a single transaction. For example, if there’s a price discrepancy between two exchanges, a trader can exploit it using a flash loan.

By eliminating the need for collateral, flash loans free up capital that would otherwise be tied up. Traders can leverage this efficiency to maximise their profits.

The native token (AAVE)

AAVE is the native governance token. Holders can participate in decision-making and propose changes to the protocol.

How Aave works

Deposits and borrowing

Users deposit their crypto assets (e.g., ETH, stablecoins) into the liquidity pools. Borrowers can then take out loans by collateralizing their assets. The interest rates vary based on supply and demand.

Interest rates

The dynamic interest rates adjust in real-time. Users can choose between stable or variable rates. Stable rates provide predictability, while variable rates respond to market conditions.

Collateralisation

Borrowers must over-collateralise their loans. If the value of their collateral drops, they risk liquidation.

Governance

AAVE holders participate in governance proposals, voting on protocol changes, and deciding the platform’s future.

What Aave is aiming to do

Financial inclusion

The platform aims to democratise access to financial services. Anyone with an internet connection can participate, regardless of their location or background.

Earn interest

Lenders earn interest by providing liquidity. It’s a way to passively grow your crypto holdings.

Flash loans

Aave’s flash loans are used mainly by developers and traders, enabling complex strategies and efficient capital utilisation.

DeFi innovation

Aave’s success has inspired other DeFi projects, contributing to the broader ecosystem’s growth.

Conclusion

Aave is more than just a lending platform; it’s a catalyst for financial innovation. Exploring the platform can deepen your understanding of blockchain, DeFi, and the future of finance.

Cash, credit or crypto?

Buy Aave instantly using Visa or Mastercard. Get cash in your account fast with bank transfer, PayID or Osko. Convert crypto-to-crypto with a single click.How to buy Aave with CoinJar

Start your portfolio with Australia's longest running crypto exchange with these simple steps.Featured In

CoinJar Card

CRYPTO SPENDING POWERED BY MASTERCARD®

CoinJar Card

CRYPTO SPENDING POWERED BY MASTERCARD®

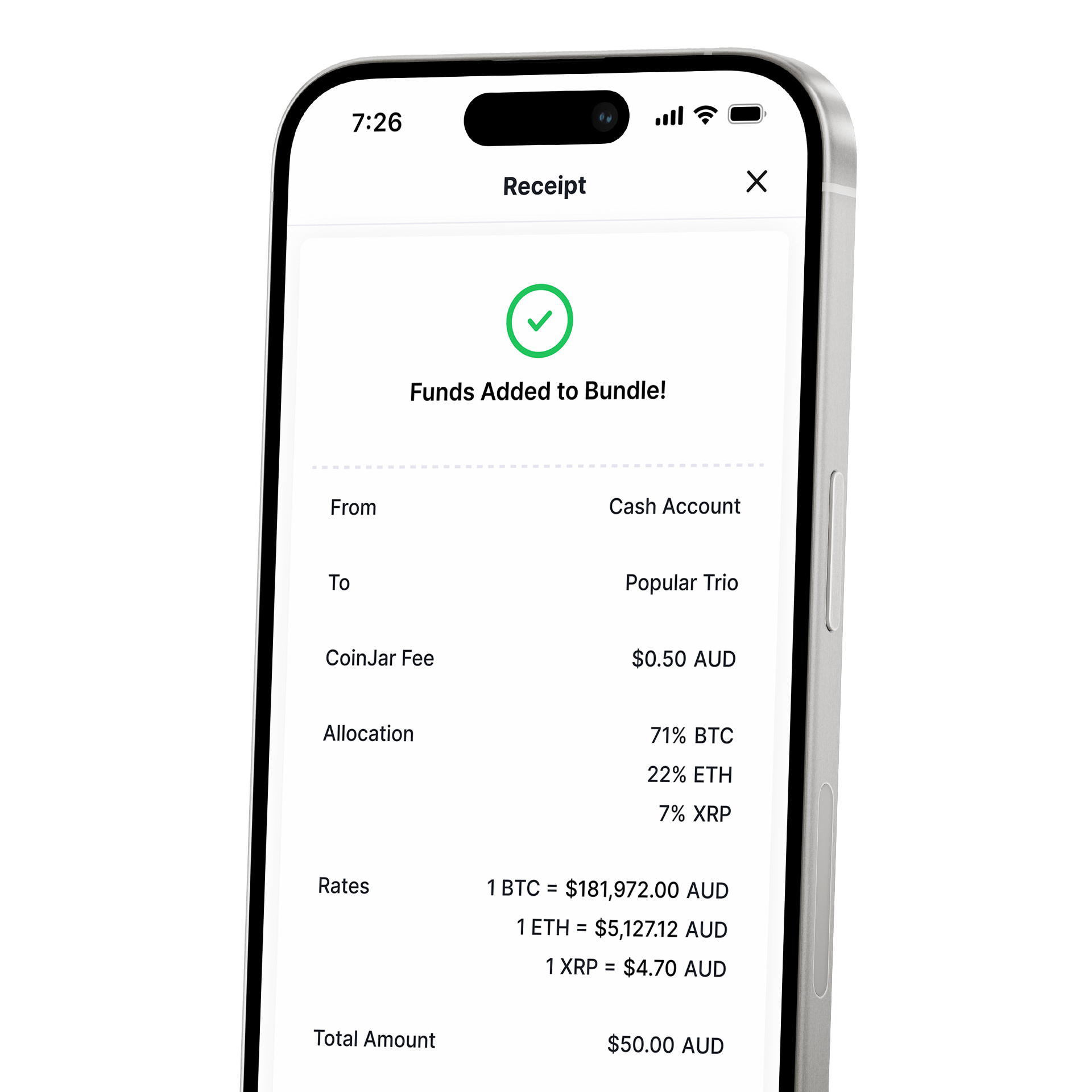

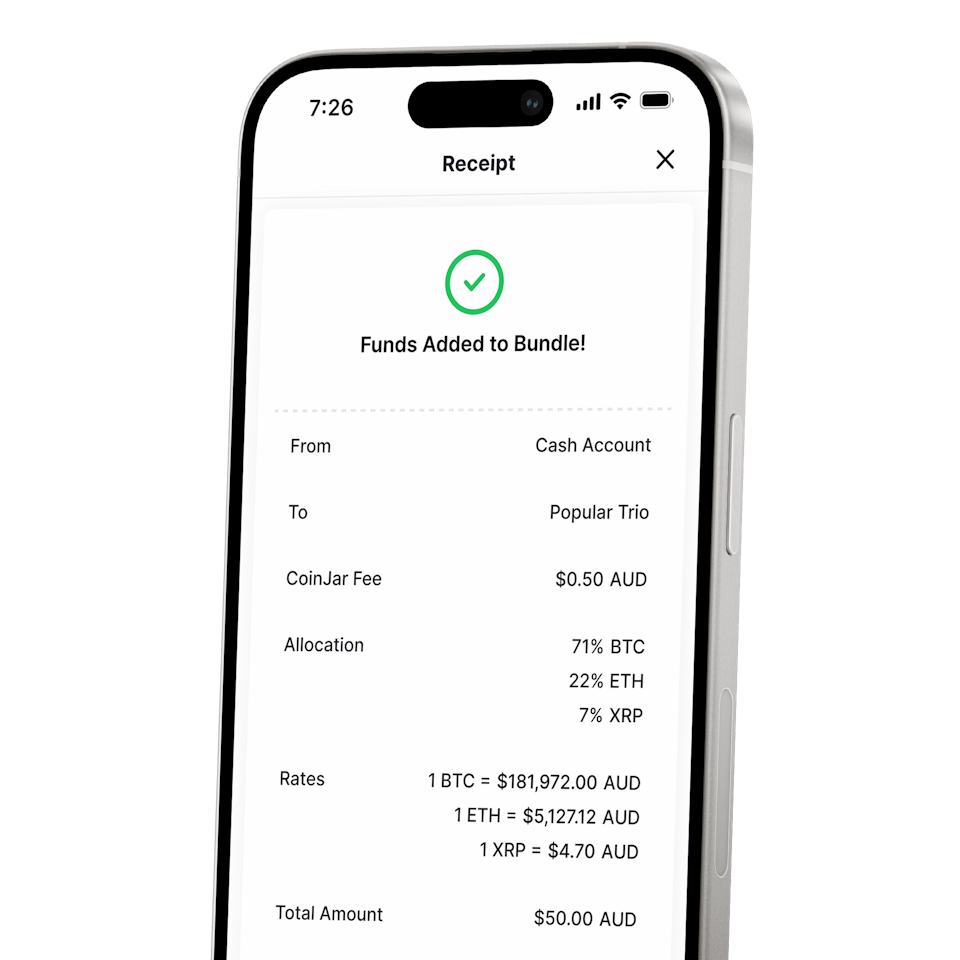

CoinJar DCA & Bundles

AUTOMATE & DIVERSIFY YOUR PORTFOLIOCoinJar DCA & Bundles

AUTOMATE & DIVERSIFY YOUR PORTFOLIO

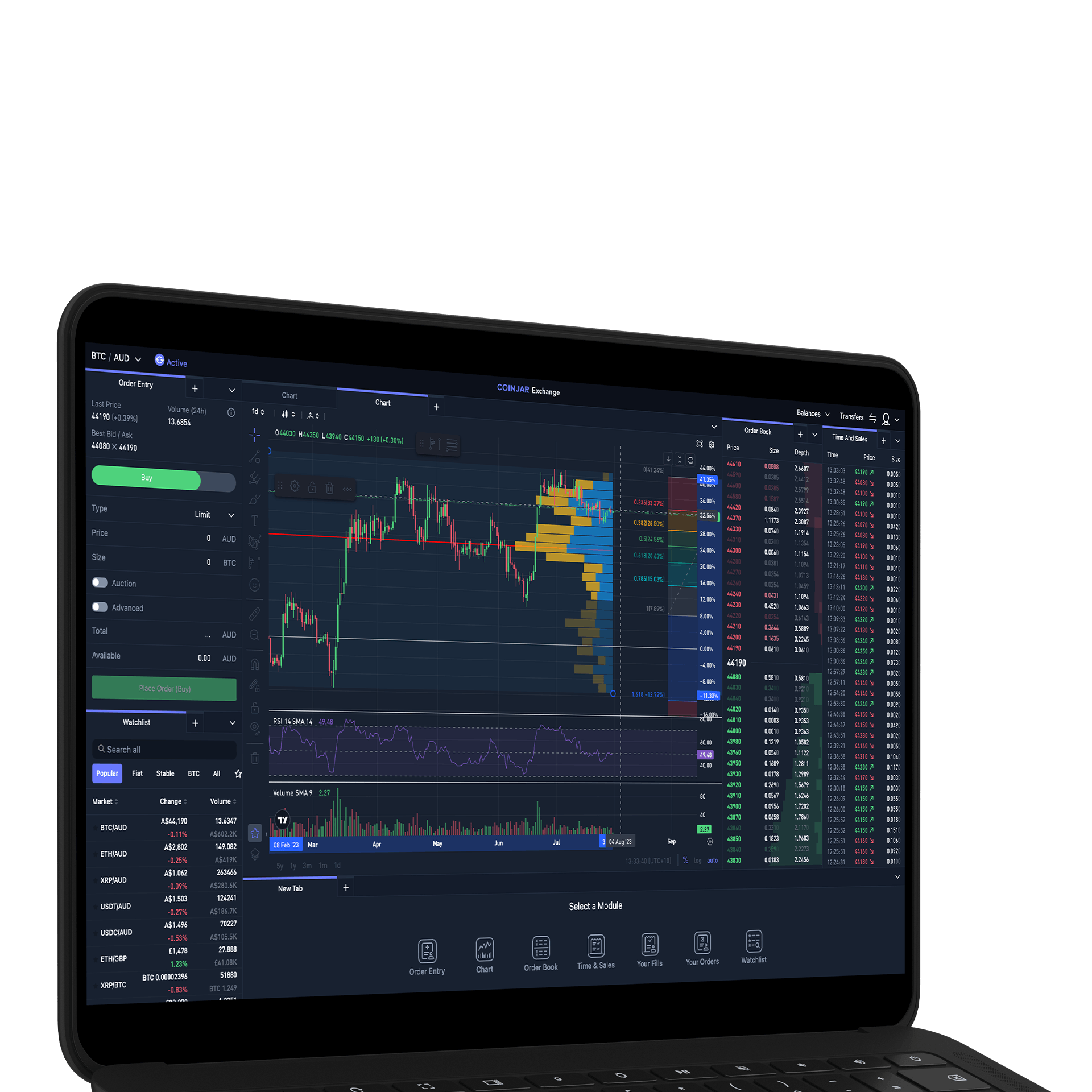

CoinJar Exchange

TRADE FOR AS LOW AS 0%

CoinJar Exchange

TRADE FOR AS LOW AS 0%Frequently asked questions

What is the Aave protocol?

It is an open-source liquidity protocol designed for creating non-custodial liquidity markets. It allows users to earn interest by supplying assets and borrow crypto assets with either a variable or stable interest rate. Aave is a decentralized platform.

It is easily integrated into various products and services.

What does “Aave is decentralised” mean?

The platform operates without central authorities or intermediaries. Users can lend and borrow cryptocurrencies directly, without relying on traditional banks or financial institutions.

What are Aave tokens?

They are an essential part of the ecosystem. They serve multiple purposes:

Governance: Token holders participate in decision-making by voting on improvements.

Safety Module: They can be staked within the protocol’s Safety Module, providing security and insurance to the protocol and suppliers.

Where can I buy Aave?

You can buy Aave on CoinJar. Simply sign up, deposit funds, and trade Aave directly from our platform.

Will Aave reach $1000?

It’s impossible to predict with certainty, as crypto prices depend on market trends, adoption, and other factors. Aave’s price will fluctuate based on supply, demand, and broader market conditions.

Is Aave a good crypto?

Aave is a decentralised finance (DeFi) protocol, known for its lending and borrowing features. Whether it’s "good" depends on your investment goals and risk tolerance—research its use case and performance to decide.

Can I trust Aave?

Aave is a project in the crypto space, backed by audited smart contracts. However, all cryptocurrencies carry risks, so ensure you understand those before investing.

Your information is handled in accordance with CoinJar’s Collection Statement.

CoinJar’s digital currency exchange services are operated by CoinJar Australia Pty Ltd ACN 648 570 807, a registered digital currency exchange provider with AUSTRAC.

CoinJar Card is a prepaid Mastercard issued by EML Payment Solutions Limited ABN 30 131 436 532 AFSL 404131 pursuant to license by Mastercard. CoinJar Australia Pty Ltd is an authorised representative of EML Payment Solutions Limited (AR No 1290193). We recommend you consider the Product Disclosure Statement and Target Market Determination before making any decision to acquire the product. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

Google Pay is a trademark of Google LLC. Apple Pay is a trademark of Apple Inc.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.