Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Onchain: OOO all of summer

July 30, 2025

That's the joke about us Europeans. I'm living proof that not everyone is like that, so here's another dose of crypto stories instead of an OOO email.

Story One

BAM

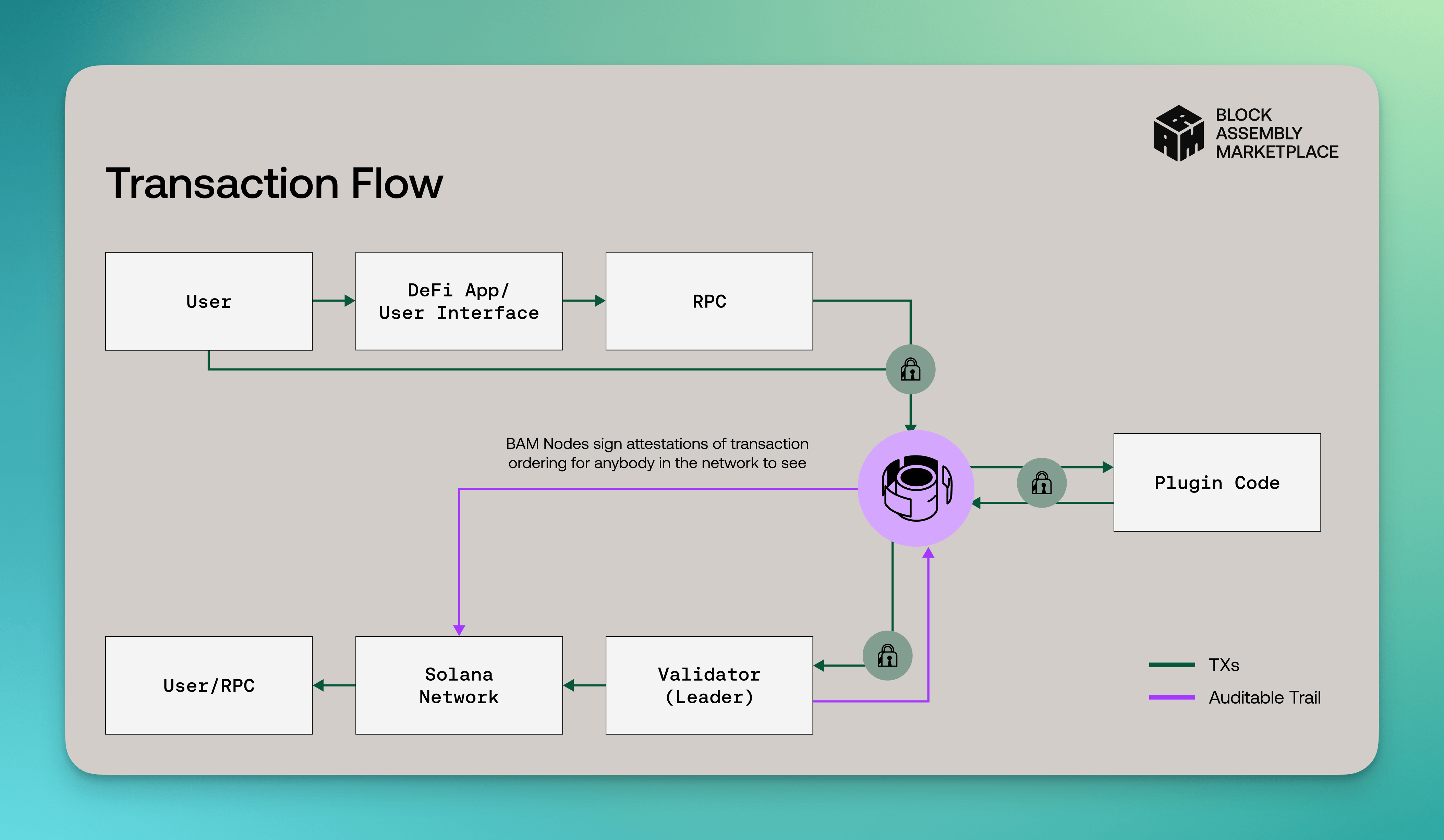

Or another reminder of how crypto people can’t help themselves but create three-letter acronyms on any occasion. BAM is short for Block Assembly Market, and if you believe the Solana fan bois, it is the latest, most exciting thing to come out of their ecosystem.

Excuse me if we’re going into nerd territory here, but what BAM does is change how transactions are processed during the block-building process. In short, it’s a product released by Jito, the leading Solana validator, which realized that it’s not a great look if they control 87% of the stake. To fix this, they built BAM, which routes all transactions through a network of nodes that sequence them within TEEs (Trusted Execution Environments).

That ensures that no one can see what happens inside, but thanks to a proof generated, they can rest assured that all the rules set out by the protocol were followed. Outside of distributing control to a network of nodes, this setup increases privacy and reduces MEV, which just means fewer users lose money.

That’s something, although it will never make up for all the money people lost gambling on what Solana founder Toly, in a hypocritical moment, called slop.

Takeaway: It’s nice to see that even in Solana-land validators realize that too much power might not be great in a decentralized network.

Story Two

Corporate treasuries everywhere

If you’ve skimmed the crypto headlines in the last few weeks, you’ll have noticed a trend. Suddenly, all corporations, from nail salons to gaming businesses, feel the need to add crypto to their treasuries. The concept is hardly new, ever since Michel Saylor’s Microstrategy became just collateral for Saylor's continued BTC purchases. Does anyone even know what MicroStrategy originally did? I doubt it.

In a similar vein, suddenly, all the companies you never heard of, such as SharpLink Gaming — now the second-biggest organizational ETH holder — and Metaplanet, are scooping up crypto like kids ice cream on a hot summer day.

Long gone are the days when only BTC and ETH were considered sensible assets; we’ve now reached a stage where even DOGE is a currency worthy of a corporate treasury.

Takeaway: You know we might be getting into bubble territory when even the Wall Street Journal, otherwise not much concerned with crypto, asks: What could possibly go wrong?

Story Three

Coinification/acc

It turns out that crypto was far from done with turning everything into a coin. A spectre is haunting our industry, and it’s that of hyperfinancialization. Culprits in question this time include Base, again, and Farcaster.

Let’s start with Base. If you go to X, you might see Jesse, Base’s mascot, no.1, post about how their new base app has grown significantly, all organically, without any incentives. Then you scroll further and you find out that that claim might be a stretch.

Turns out that when posting anything in the Base app, it automatically generates a coin. People can buy into that coin, and creators are supposedly thus able to monetize on the attention.

Farcaster has introduced a similar feature, where every cast (that’s what they call posts) is now also a collectible that people can buy starting at $1. Similarly, the blogging platform I use also asks me now whether I want to coin my essays. I’d rather go to a Cardano meetup.

Takeaway: Once again, this supposed attempt to help creators get paid exposes how little time crypto builders spent understanding the problem at hand. Instead, they created yet another pvp game.

Fact of the week: Once again, this supposed attempt to help creators get paid exposes how little time crypto builders spent understanding the problem at hand. Instead, they created yet another pvp game.

Naomi for CoinJar

Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Cryptoassets traded on CoinJar UK Limited are largely unregulated in the UK, and you are unable to access the Financial Service Compensation Scheme or the Financial Ombudsman Service. We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets. We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits.

CoinJar’s digital currency exchange services are operated in the United Kingdom by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767).

On/Offchain

Your weekly dose of crypto news & opinion.

Join more than 150,000 subscribers to CoinJar's crypto newsletter.

Your information is handled in accordance with CoinJar’s Privacy Policy.

More from CoinJar Blog

CoinJar Exchange Now Offers PDF Account Statements

September 11, 2025You can now get account statements in PDF format for your activity on CoinJar Exchange. Read more

Onchain: Wake me up, when September ends

September 11, 2025Or don't, because then I could miss out on many more corporate blockchain launches. Story One Yet another corporate blockchain Tempo is a new Layer-1 purpose-built for...Read more

CoinJar Announces SKY Token Listing

September 9, 2025SKY token is now available for trading on CoinJar! Here's everything you need to know about the getting your hands on the upgraded DeFi coin.Read moreYour information is handled in accordance with CoinJar’s Privacy Policy.

Cryptoassets traded on CoinJar UK Limited are largely unregulated in the UK, and you are unable to access the Financial Service Compensation Scheme or the Financial Ombudsman Service.

We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets. We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits.

CoinJar’s digital currency exchange services are operated in the UK by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767).

Apple Pay and Apple Watch are trademarks of Apple Inc. Google Pay is a trademark of Google LLC.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.