Buy Aave (AAVE) with CoinJar

Aave

AAVE

Overview

How to buy Aave with CoinJar

Start your cryptocurrency portfolio with CoinJar by following these simple steps.What is Aave?

Buy Aave: Why do investors buy Aave? On Planet Crypto, Aave is an interesting decentralised lending platform that is worth investigating. So here’s the skinny on what you can do on the protocol.

Aave emerged from the brain of Stani Kulechov, who founded a venture called ETHLend in 2017.

Inspired by Ethereum’s capabilities, Kulechov aimed to create a peer-to-peer lending and borrowing platform.

In January 2020, he rebranded ETHLend as Aave and launched it on the Ethereum mainnet. Since then, Aave has expanded to other blockchain networks, including Avalanche, Fantom, Harmony, Arbitrum, Polygon, and Optimism.

What you can do on the platform

Decentralised lending

The platform allows users to lend and borrow digital assets without intermediaries like banks. It’s a trustless system where smart contracts handle transactions transparently.

Liquidity pools

Users deposit into liquidity pools. These pools serve as the source of funds for borrowers. Lenders earn interest by contributing to these pools.

Flash loans

Flash loans are a unique type of loan available on the platform.

Flash loans are lightning-fast loans that don’t require any collateral. Unlike traditional loans, where you need to put up assets as security, flash loans allow you to borrow without providing collateral upfront.

The catch is that you must repay the entire loan amount within the same transaction. If you fail to do so, the entire transaction is reversed, and the loan is canceled. This tight timeframe ensures that flash loans are used for specific purposes and don’t linger indefinitely.

Flash loans are popular among traders and arbitrageurs. They can borrow funds instantly, execute profitable trades across different platforms, and then repay the loan all within a single transaction. For example, if there’s a price discrepancy between two exchanges, a trader can exploit it using a flash loan.

By eliminating the need for collateral, flash loans free up capital that would otherwise be tied up. Traders can leverage this efficiency to maximise their profits.

The native token (AAVE)

AAVE is the native governance token. Holders can participate in decision-making and propose changes to the protocol.

How Aave works

Deposits and borrowing

Users deposit their crypto assets (e.g., ETH, stablecoins) into the liquidity pools. Borrowers can then take out loans by collateralizing their assets. The interest rates vary based on supply and demand.

Interest rates

The dynamic interest rates adjust in real-time. Users can choose between stable or variable rates. Stable rates provide predictability, while variable rates respond to market conditions.

Collateralisation

Borrowers must over-collateralise their loans. If the value of their collateral drops, they risk liquidation.

Governance

AAVE holders participate in governance proposals, voting on protocol changes, and deciding the platform’s future.

What Aave is aiming to do

Financial inclusion

The platform aims to democratise access to financial services. Anyone with an internet connection can participate, regardless of their location or background.

Earn interest

Lenders earn interest by providing liquidity. It’s a way to passively grow your crypto holdings.

Flash loans

Aave’s flash loans are used mainly by developers and traders, enabling complex strategies and efficient capital utilisation.

DeFi innovation

Aave’s success has inspired other DeFi projects, contributing to the broader ecosystem’s growth.

Conclusion

Aave is more than just a lending platform; it’s a catalyst for financial innovation. Exploring the platform can deepen your understanding of blockchain, DeFi, and the future of finance.

Bank transfer (ACH and wire), or crypto?

Buy Aave instantly with your bank account via ACH or deposit with wire transfer. Easily buy with ACH, wire cash to your account, or swap one cryptocurrency for another in a single click.Featured In

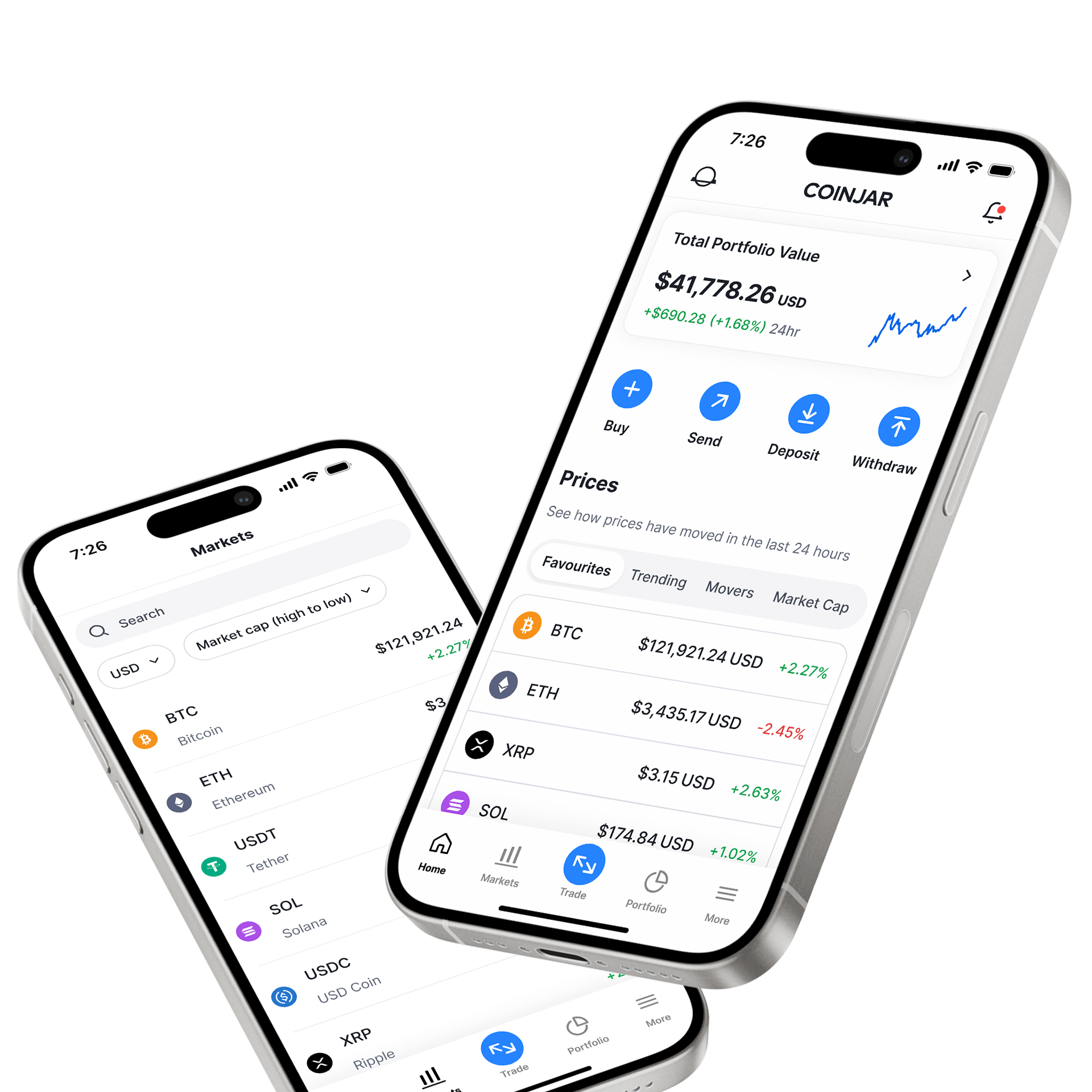

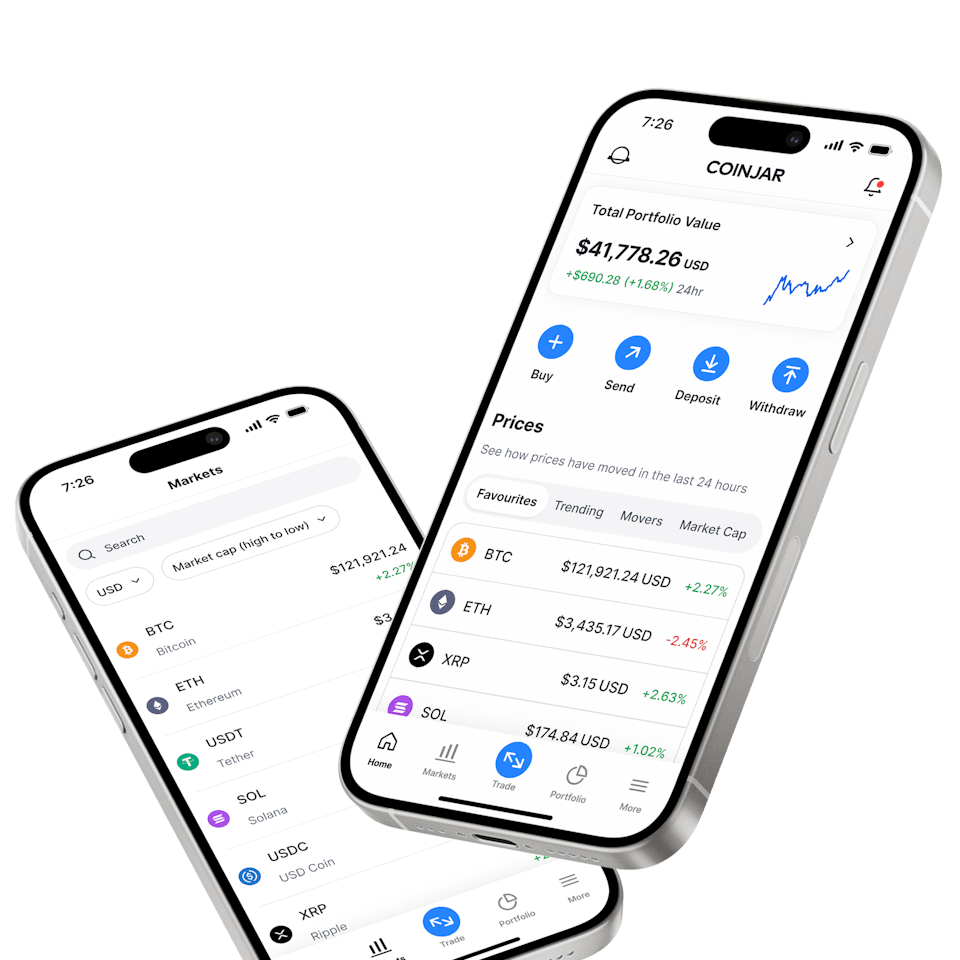

CoinJar App

All-in-one crypto walletCoinJar App

All-in-one crypto wallet

Frequently asked questions

What is the Aave protocol?

It is an open-source liquidity protocol designed for creating non-custodial liquidity markets. It allows users to earn interest by supplying assets and borrow crypto assets with either a variable or stable interest rate. Aave is a decentralized platform.

It is easily integrated into various products and services.

What does “Aave is decentralized” mean?

The platform operates without central authorities or intermediaries. Users can lend and borrow cryptocurrencies directly, without relying on traditional banks or financial institutions.

What are Aave tokens?

They are an essential part of the ecosystem. They serve multiple purposes:

Governance: Token holders participate in decision-making by voting on improvements.

Safety Module: They can be staked within the protocol’s Safety Module, providing security and insurance to the protocol and suppliers.

How can I learn more about Aave before purchasing?

Before buying Aave, it's crucial to research and understand key factors like cryptocurrency prices.

Know the all-time high (highest price paid for Aave ever), current circulating supply of Aave, market cap (total value of all Aave tokens), and 24-hour trading volume (total value traded in the last 24 hours).

These metrics can be found on reputable cryptocurrency exchanges and websites like CoinMarketCap.

Your information is handled in accordance with CoinJar’s Privacy Policy.

Copyright © 2025 CoinJar, Inc. All rights reserved.

CoinJar, Inc. is a registered Money Services Business with FinCEN and licensed as a money transmitter, NMLS #2492913. For a list of states in which CoinJar, Inc. is licensed or authorized to operate, please visit here. In certain other states, money transmission services are provided by Cross River Bank, Member FDIC.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.