Get $20 in free Bitcoin when you sign up and buy $50+ in crypto before October 31, 2025. Terms apply.

Buy Tether (USDT) with CoinJar

Tether

USDT

How to buy Tether with CoinJar

Start your cryptocurrency portfolio with CoinJar by following these simple steps.What is Tether?

TLDR:

- Investors are looking to buy Tether

- Tether is the most popular stablecoin in the world.

- Here's how to buy Tether easily with CoinJar.

Buy Tether

Why do people buy Tether? Tether (USDT) is the original stablecoin. The Tether whitepaper was first released back in 2012, although the token itself didn’t find widespread use until it was adopted by the exchange Bitfinex in 2015.

At a time when it was difficult for cryptocurrency exchanges to find reliable banking and fiat currency partners, Tether offered a way around the roadblock for the growing crypto industry.

Offering a token that Tether claimed was backed 1:1 with actual US dollars, users could trade USDT without the fiat currency itself having to go anywhere.

Tether is a stablecoin designed to maintain a peg to the US dollar, and (at the time of writing, June 2024) USDT boasts the largest market cap among all stablecoins.

How does USDT maintain its value?

Tether claims that USDT is pegged at 1-to-1 with a matching fiat currency and is backed 100% by Tether’s reserves. Users can view the value of USDT tokens on issue versus its total reserves on Tether’s Transparency Page. It shows the value of USDT tokens on issue versus its total reserves.

What risks should I be aware of when purchasing Tether?

Customers should be aware that there have been no formal independent audits of Tether’s purported reserves. Tether releases quarterly reports which contain Tether’s attestations about their consolidated assets and liabilities.

These quarterly reports have shown that Tether’s reserves are made up of cash, cash equivalents (such as U.S. Treasury Bills), short-term deposits, corporate bonds, precious metals, Bitcoin, “other investments” and secured loans.

Tether’s terms of service also allow Tether to delay the redemption or withdrawal of Tether if there is illiquidity, unavailability, or loss of any reserves held by Tether.

Bank transfer (ACH and wire), or crypto?

Buy Tether instantly with your bank account via ACH or deposit with wire transfer. Easily buy with ACH, wire cash to your account, or swap one cryptocurrency for another in a single click.Featured In

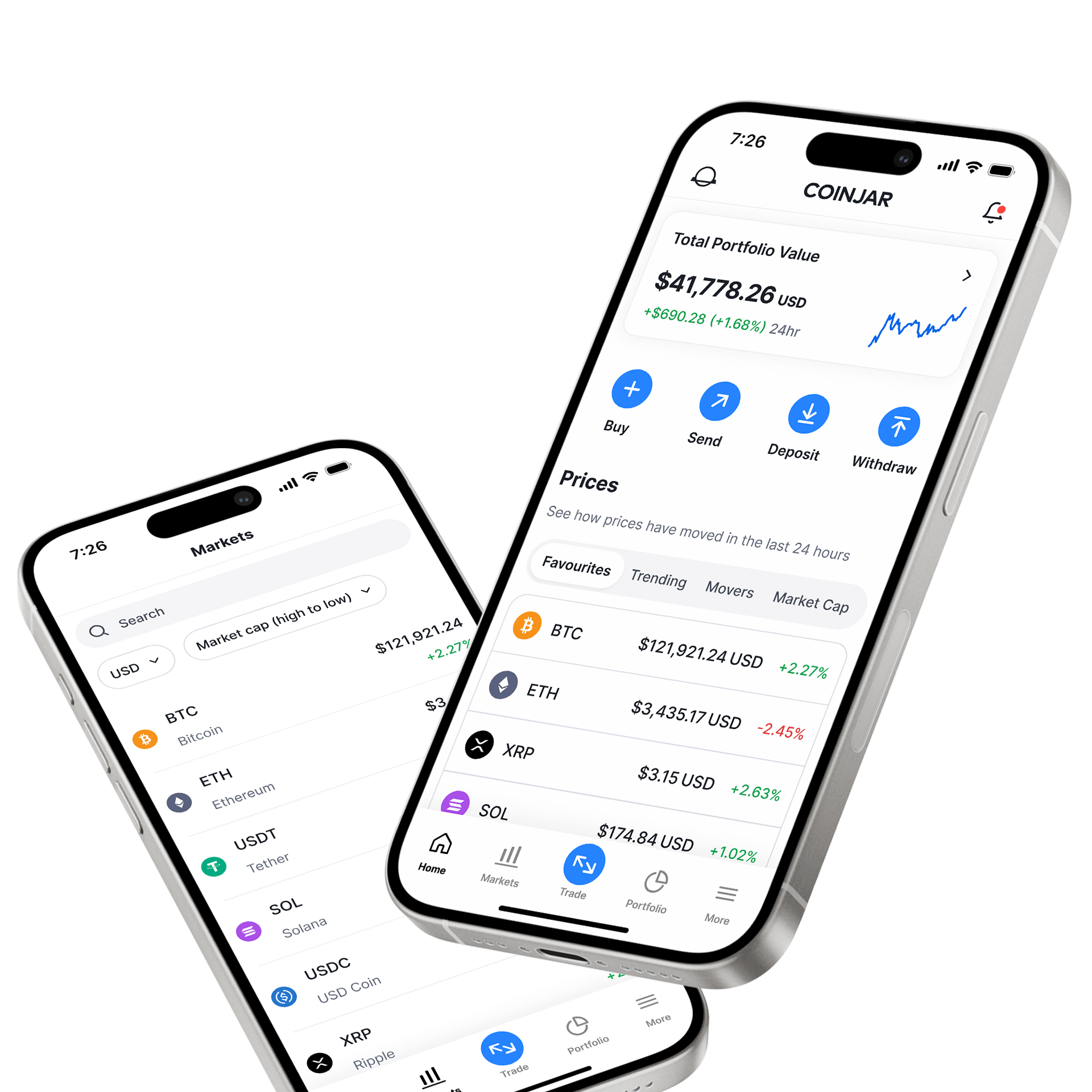

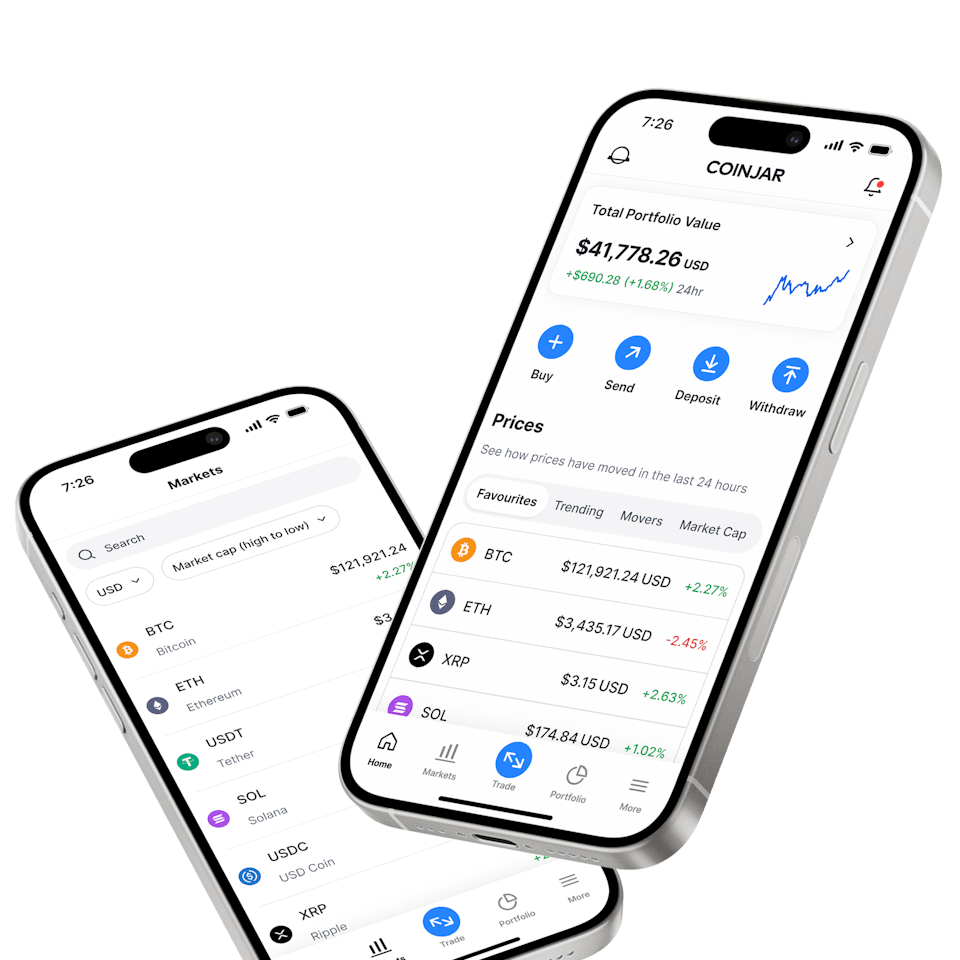

CoinJar App

All-in-one crypto walletCoinJar App

All-in-one crypto wallet

Frequently asked questions

What is Tether (USDT)?

Launched in 2014 by Brock Pierce, Reeve Collins, and Craig Sellars, Tether is a stablecoin pegged to the value of the US dollar. This means its value is designed to remain stable, unlike other cryptocurrencies like Bitcoin Cash.

How can I purchase Tether on CoinJar?

You can easily buy Tether (USDT) on CoinJar by using ACH for instant purchase, or by depositing funds via wire transfer into your CoinJar balance.

Is there a minimum amount of Tether I can buy?

Yes, the minimum amount of Tether you can purchase will vary depending on the current market price and CoinJar's policies.

What blockchain networks does CoinJar support for Tether?

CoinJar currently supports Tether on Ethereum. You'll be able to choose your preferred network during your purchase.

Why is Tether's trading volume important?

High trading volume indicates strong liquidity, meaning it's easier to buy and sell USDT at stable prices. You can check USDT's trading volume on CoinJar or other exchanges.

How is Tether used in commodity futures trading?

Traders use Tether to quickly move funds between exchanges and hedge against the volatility of traditional currencies.

What are the total USDT tokens in circulation?

The amount of USDT tokens in circulation changes constantly. You can view the current number on various crypto data websites or on the Tether Transparency page.

Who is the current CEO of Tether?

The CEO of Tether Limited is Paolo Ardoino.

What is the EOS Liquid Network?

The Liquid Network is a sidechain of the EOS blockchain that offers faster transaction speeds and enhanced privacy features for USDT transactions.

Why would I use Tether instead of traditional currency for crypto trading?

USDT allows you to quickly move funds between exchanges without needing to convert to traditional currency, saving time and potential conversion fees.

Your information is handled in accordance with CoinJar’s Privacy Policy.

Copyright © 2025 CoinJar, Inc. All rights reserved.

CoinJar, Inc. is a registered Money Services Business with FinCEN and licensed as a money transmitter, NMLS #2492913. For a list of states in which CoinJar, Inc. is licensed or authorized to operate, please visit here. In certain other states, money transmission services are provided by Cross River Bank, Member FDIC.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.