Get $20 in free Bitcoin when you sign up and buy $50+ in crypto before October 31, 2025. Terms apply.

Buy Universal Market Access (UMA) with CoinJar

Universal Market Access

UMA

How to buy Universal Market Access with CoinJar

Start your cryptocurrency portfolio with CoinJar by following these simple steps.What is Universal Market Access?

UMA, short for Universal Market Access, is an Ethereum-based protocol that serves as an optimistic oracle. But what does that mean?

What is an oracle?

Say you are at work, and you need to know the current weather outside. You can’t step out to check it yourself, so you ask someone else (an oracle) to tell you. In the blockchain world, oracles provide real-world data to smart contracts. They bridge the gap between the digital and physical worlds.

What is an optimistic oracle?

UMA is like a “human-powered truth machine.” It verifies real-world data and brings it onto the blockchain. If there are no disputes around the data, it’s assumed to be accurate. So, UMA’s oracle system allows for various types of data to be securely integrated on-chain.

What are some interesting projects using the UMA protocol?

There are some great projects that use UMA.

Why do people buy UMA?

Decentralized Finance (DeFi)

UMA is part of the DeFi movement. DeFi aims to create financial services without relying on traditional banks or intermediaries. The UMA protocol is enables users to create decentralized financial contracts and synthetic assets.

The UMA token is also used for governance of the UMA protocol, allowing holders to vote on proposals and changes. It also incentivizes participation in the network's Data Verification Mechanism, which ensures accurate price data for synthetic assets created on the platform.

Creating synthetic tokens

The UMA protocol allows anyone to create synthetic tokens tied to real-world assets (like stocks, commodities, or currencies). These synthetic tokens mirror the value of the underlying asset without directly owning it. For example, you can create a synthetic token representing Tesla stock without actually buying Tesla shares.

Governance and voting

UMA token holders have a say in the protocol’s governance. They can vote on decisions like upgrades, new synthetic assets, and dispute resolutions. When a vote happens, the total token supply increases slightly, rewarding those who participate.

How does UMA work?

Request

A smart contract requests data from UMA’s oracle. This data could be anything — stock prices, weather, election results, etc.

Propose

Someone proposes a data point. They post a bond and offer the data. If there’s no dispute during the specified period, the data is assumed true, and the proposer gets their bond back.

Dispute

If someone disagrees with the data, they can dispute it. UMA token holders resolve the dispute through voting. If the disputer is right, they get a reward; if wrong, they lose their bond.

Conclusion: Why buy UMA

UMA’s technology aims to make global markets fair, accessible, secure, and decentralized. It’s a fascinating project that combines blockchain, finance, and community governance. So, next time you hear about UMA, remember it’s not just a crypto token — it’s a bridge between the digital and real worlds.

Bank transfer (ACH and wire), or crypto?

Buy Universal Market Access instantly with your bank account via ACH or deposit with wire transfer. Easily buy with ACH, wire cash to your account, or swap one cryptocurrency for another in a single click.Featured In

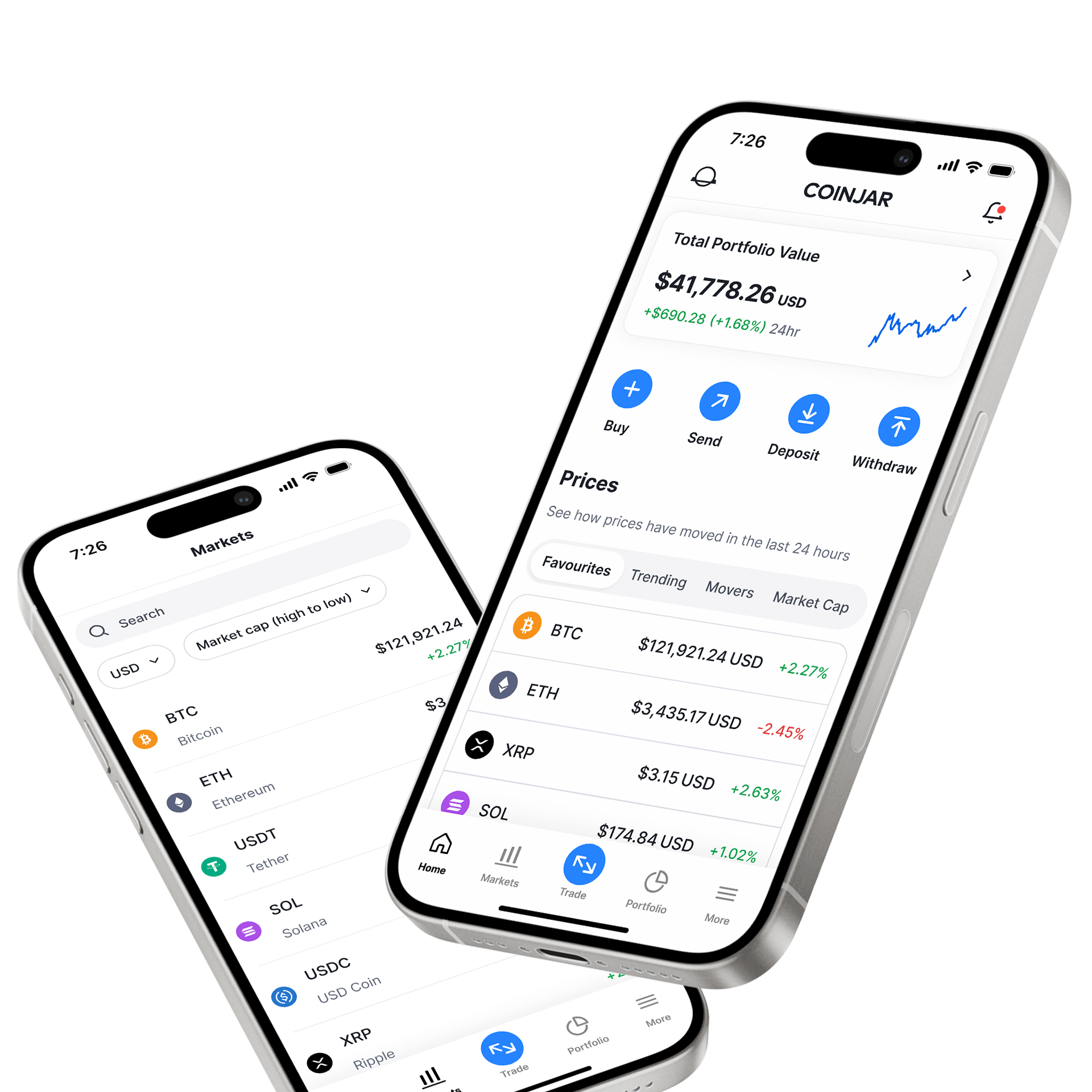

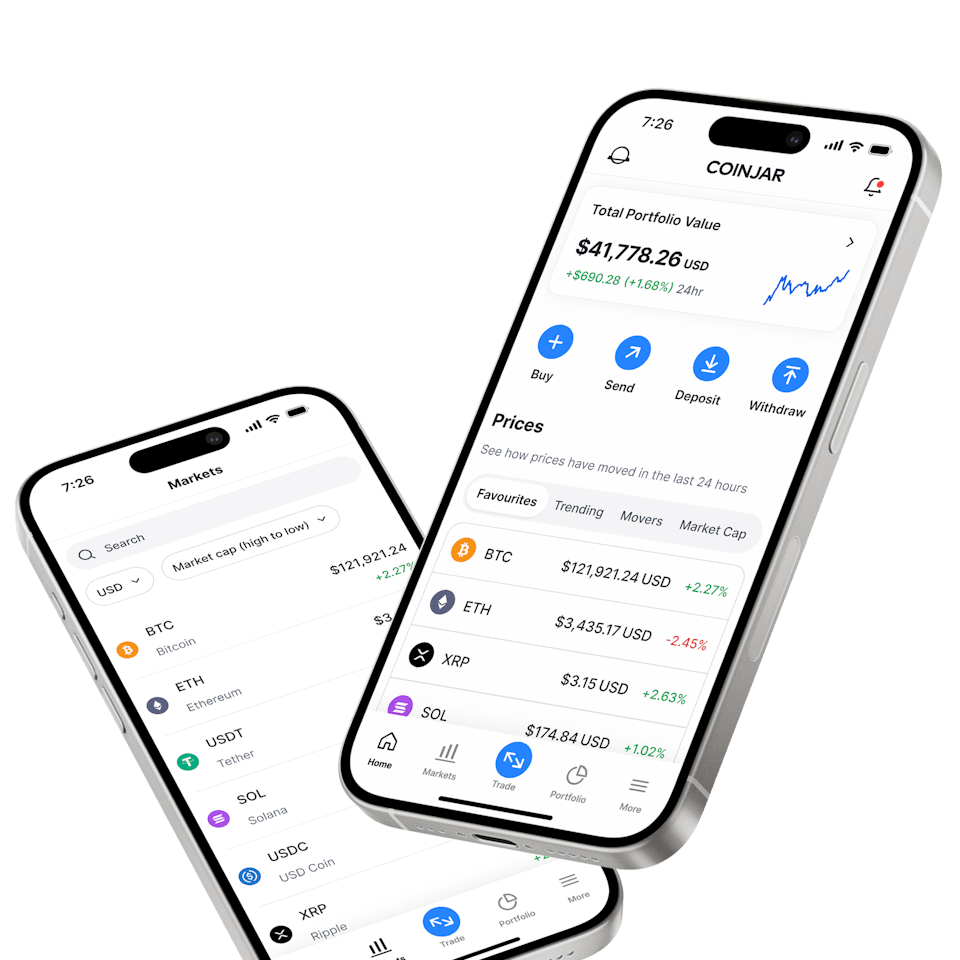

CoinJar App

All-in-one crypto walletCoinJar App

All-in-one crypto wallet

Frequently asked questions

How do investors trade UMA?

To trade UMA, create an account on a crypto exchange such as CoinJar, select your desired UMA trading pair (e.g., UMA/USD), and start trading. You can buy, sell, and trade UMA based on market conditions.

Where can you buy UMA?

UMA tokens can be traded on several centralized cryptocurrency exchanges, including CoinJar.

As one of the longest-running crypto platforms, CoinJar provides a secure and intuitive way to buy, sell, and store UMA. After creating an account and completing identity verification, users can link their bank account to buy UMA instantly via ACH, or fund their account through wire transfer and trade once the deposit clears.

Where can investors store my UMA?

You can store UMA in a protected wallet or simply in your CoinJar wallet.

CoinJar Wallet: CoinJar provides its own wallet service. It is convenient, however being an online wallet there is a risk that it may be a victim of a cyberattack. Online wallets are also called “hot wallets”.

External Wallets: If you want to hold on to your UMA for a while, you can transfer your UMA to an external wallet. Hardware wallets are also known as “cold wallets” (like Ledger or Trezor) and these are effective for long-term storage as they are offline and seriously difficult to hack.

CoinJar has been operating since 2013. CoinJar keeps the vast majority of customer assets in cold storage or private multi-sig wallets and maintains full currency reserves at all times.

What are the current cryptocurrency prices for UMA?

The value of UMA fluctuates based on market demand. Check reliable sources like at the top of this page, or CoinGecko for real-time UMA prices in various currencies.

How much does it cost to buy 1 UMA?

At the current market rate on 21 May 2024, it costs approximately $1.30 (30 July 2025) to purchase one UMA.

What is the process for purchasing UMA with a bank account?

Transfer fiat currency from your bank account to a crypto exchange (e.g., CoinJar) and use the funds to buy UMA.

Is Uma coin a good investment?

The potential of UMA as an investment depends on various factors. UMA (Universal Market Access) is an open-source protocol that allows developers to create their own financial contracts and synthetic assets.

UMA operates through an optimistic oracle system, which aims to record verifiable truths onto a blockchain. UMA’s flexibility and unique dispute resolution mechanism make it a noteworthy project. However, like any investment, it carries risks.

What is the price prediction for UMA crypto?

Price predictions vary, but one estimate is that MA was predicted to reach approximately $4.84, in 2024.

Other predictions said that the price will swing from US$3.49 to a high of US$8.28 in 2024.

However some other predictions have the coin bottoming out at US$1.30 in 2025. Be sure to do your own research or you could even speak to a financial advisor.

Your information is handled in accordance with CoinJar’s Privacy Policy.

Copyright © 2025 CoinJar, Inc. All rights reserved.

CoinJar, Inc. is a registered Money Services Business with FinCEN and licensed as a money transmitter, NMLS #2492913. For a list of states in which CoinJar, Inc. is licensed or authorized to operate, please visit here. In certain other states, money transmission services are provided by Cross River Bank, Member FDIC.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.